Okay, here’s a comprehensive article about international travel insurance, designed to be around 1200 words. I’ve focused on providing useful information and a clear structure.

International Travel Insurance: Your Essential Guide to Worry-Free Global Adventures

Traveling internationally is an exciting prospect, filled with the promise of new cultures, breathtaking landscapes, and unforgettable experiences. However, venturing beyond your home country also introduces potential risks that can quickly turn a dream trip into a nightmare. That’s where international travel insurance comes in. It’s a crucial safety net designed to protect you from unexpected events that could disrupt your travel plans and drain your finances. This comprehensive guide will explore the importance of international travel insurance, what it covers, how to choose the right policy, and tips for making the most of your coverage.

Why You Need International Travel Insurance

While many travelers hope for smooth and uneventful trips, reality often throws curveballs. Here’s why investing in international travel insurance is a smart and responsible decision:

-

Medical Emergencies: Healthcare costs vary dramatically from country to country. A simple visit to a doctor or a short hospital stay in some destinations can result in bills running into the thousands of dollars. Your domestic health insurance may offer limited or no coverage abroad, leaving you vulnerable to significant financial burdens. International travel insurance provides coverage for medical expenses, including doctor visits, hospital stays, emergency medical evacuation, and repatriation (returning you to your home country for further treatment).

-

Trip Cancellations and Interruptions: Life is unpredictable. Unexpected events, such as illness, injury, family emergencies, or natural disasters, can force you to cancel or interrupt your trip. International travel insurance can reimburse you for non-refundable travel expenses, such as flights, hotels, tours, and activities, if you have to cancel or cut short your trip due to a covered reason.

-

Lost or Stolen Luggage: Losing your luggage can be incredibly frustrating, especially when it contains essential items like medication, clothing, and travel documents. International travel insurance can compensate you for the loss, theft, or damage of your luggage and personal belongings. It can also cover the cost of essential items you need to purchase while your luggage is delayed.

-

Travel Delays: Flight delays, missed connections, and other travel disruptions can throw your itinerary into chaos. International travel insurance can cover expenses incurred due to travel delays, such as meals, accommodation, and transportation.

-

Personal Liability: Accidents happen. If you accidentally cause injury to someone else or damage their property while traveling, you could be held liable for the costs. International travel insurance can provide coverage for legal expenses and compensation you may be required to pay.

-

Peace of Mind: Knowing that you have a safety net in place can significantly reduce stress and anxiety while traveling. International travel insurance allows you to relax and enjoy your trip, knowing that you’re protected from unexpected events.

What Does International Travel Insurance Cover?

The specific coverage provided by international travel insurance policies can vary depending on the provider and the plan you choose. However, most comprehensive policies typically include the following:

-

Medical Coverage: This is the cornerstone of any good international travel insurance policy. It covers medical expenses incurred due to illness or injury, including:

- Doctor visits

- Hospital stays

- Emergency medical evacuation

- Repatriation

- Prescription medications

- Dental emergencies

-

Trip Cancellation Coverage: This covers non-refundable travel expenses if you have to cancel your trip due to a covered reason, such as:

- Illness or injury

- Death of a family member

- Natural disasters

- Terrorist attacks

- Job loss

-

Trip Interruption Coverage: This covers non-refundable travel expenses and additional costs if you have to interrupt your trip due to a covered reason, such as:

- Illness or injury

- Death of a family member

- Natural disasters

- Terrorist attacks

-

Baggage Loss or Delay Coverage: This covers the loss, theft, or damage of your luggage and personal belongings. It can also cover the cost of essential items you need to purchase while your luggage is delayed.

-

Travel Delay Coverage: This covers expenses incurred due to travel delays, such as:

- Meals

- Accommodation

- Transportation

-

Accidental Death and Dismemberment Coverage: This provides a lump-sum payment in the event of accidental death or dismemberment during your trip.

-

Personal Liability Coverage: This covers legal expenses and compensation you may be required to pay if you accidentally cause injury to someone else or damage their property.

-

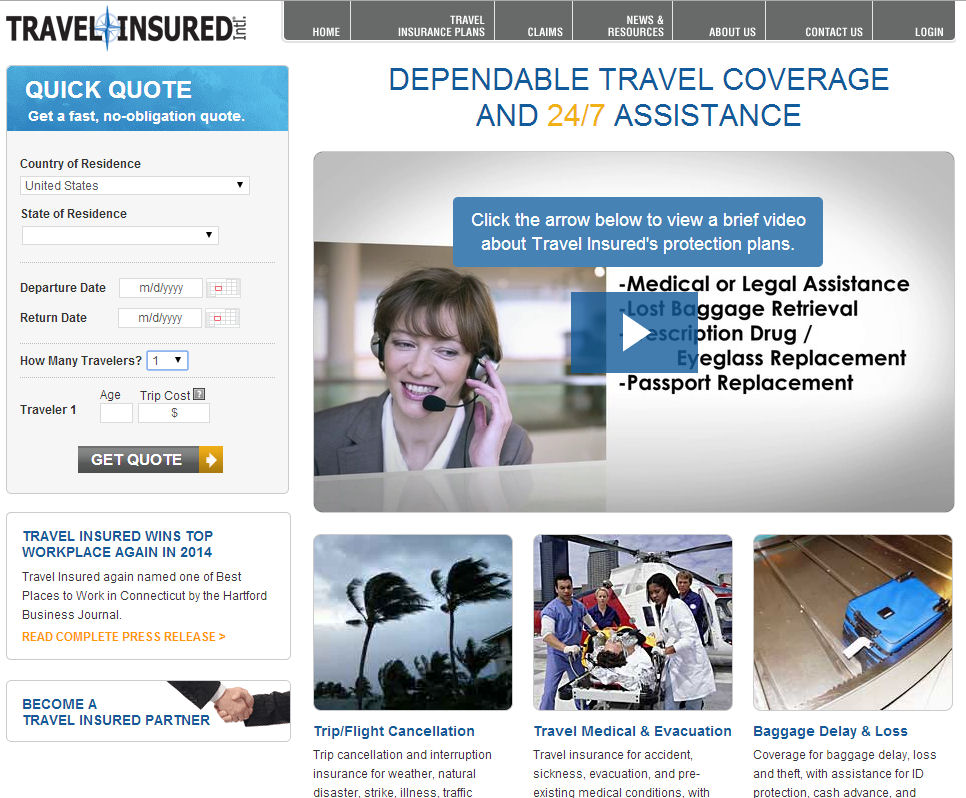

24/7 Assistance: Most international travel insurance policies offer 24/7 assistance services, providing you with access to a helpline that can assist you with medical emergencies, travel arrangements, and other issues.

How to Choose the Right International Travel Insurance Policy

Choosing the right international travel insurance policy can be overwhelming, given the wide range of options available. Here are some factors to consider:

-

Destination: The cost of healthcare and the prevalence of certain risks can vary depending on your destination. Make sure your policy provides adequate coverage for the specific region you’re visiting.

-

Trip Length: The longer your trip, the more coverage you’ll need. Consider purchasing a policy that covers the entire duration of your trip.

-

Activities: If you plan to participate in adventure activities, such as skiing, scuba diving, or rock climbing, make sure your policy covers these activities. Some policies exclude coverage for certain high-risk activities.

-

Pre-existing Medical Conditions: If you have any pre-existing medical conditions, be sure to disclose them to the insurance provider. Some policies may exclude coverage for pre-existing conditions, while others may offer coverage with certain limitations.

-

Coverage Limits: Pay attention to the coverage limits for each benefit. Make sure the limits are sufficient to cover potential expenses.

-

Deductible: The deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. Choose a deductible that you’re comfortable with.

-

Policy Exclusions: Carefully review the policy exclusions to understand what is not covered.

-

Reputation of the Insurance Provider: Choose a reputable insurance provider with a strong track record of paying claims.

-

Price: Compare quotes from multiple insurance providers to find the best value for your money. Don’t just focus on the cheapest policy; consider the coverage and benefits offered.

Tips for Making the Most of Your International Travel Insurance

-

Read the Policy Carefully: Before you travel, take the time to read your insurance policy carefully to understand what is covered and what is not.

-

Carry Your Insurance Information with You: Keep a copy of your insurance policy and contact information with you at all times. You may also want to store a digital copy on your smartphone or tablet.

-

Contact the Insurance Provider Before Seeking Medical Treatment: In non-emergency situations, contact your insurance provider before seeking medical treatment. They can direct you to approved medical facilities and help you with the claims process.

-

Keep All Receipts and Documentation: Keep all receipts and documentation related to your medical expenses, travel delays, or lost luggage. You’ll need these to file a claim.

-

File a Claim as Soon as Possible: File a claim as soon as possible after an incident occurs. Most insurance policies have a deadline for filing claims.

-

Be Honest and Accurate: When filing a claim, be honest and accurate in your responses. Providing false information can invalidate your claim.

Conclusion

International travel insurance is an essential investment for anyone traveling abroad. It provides a safety net that can protect you from unexpected events and financial burdens. By understanding what international travel insurance covers, how to choose the right policy, and how to make the most of your coverage, you can travel with confidence and enjoy a worry-free global adventure. Don’t leave home without it!